how does maine tax retirement income

Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming. However that deduction is reduced in an amount equal to your annual Social Security benefit.

In Montana only 4110 of income can be exempt and your adjusted federal gross income must be less than.

. You will have to manually enter this subtraction after creating your Maine return. The difference is that their exemptions are quite scanty compared with the average. According to the Maine Department of Revenue Military pension benefits including survivor benefits will be completely exempt from the State of Maines income tax.

Arizona Taxes on Retirees. Individual Income Tax 1040ME Maine generally imposes an income tax on all individuals that have Maine-source income. The average low temperatures in Maine are about 12F -111C while the average high is 70F.

Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income. Download a sample explanation Form 1099-R and the information reported on it. Maine allows for a deduction of up to 10000 per year on pension income.

The income tax rates are graduated with rates ranging from 58 to 715 for tax years beginning after 2015. In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who received either a benefit payment or a refund of contributions in the prior calendar year. If you file as part of a couple and earn a combined income of between 32000 and 44000 up to 50 percent of your benefits may be subject to taxation.

For more information call the Compliance Division of Maine Revenue Services at 207 624-9595 or e-mail compliancetaxmainegov. The 10000 must be reduced by all taxable and nontaxable social security and railroad benefits. For tax years beginning on or after January 1 2016 the benefits received under a military retirement plan including survivor benefits are fully exempt from Maine income tax.

Nine of those states that dont tax retirement plan income simply because distributions from retirement plans are considered income and these nine states have no state income taxes at all. Luckily while you have to watch out for the Maine state income tax your. To access this entry please go to.

On the other hand if you earn more than 44000 up to 85 percent of your Social Security benefits may be taxed. It is no secret that the weather in Maine can get fairly cold during the winter months and the amount of snowfall that typically occurs can be quite high. A lack of tax.

June 6 2019 239 AM. Married filers that both. The remaining three Illinois Mississippi.

255 on up to 54544 of taxable income for married filers and up to 27272 for single filers. State Income Tax Range. First the first 10000 of any retirement income taxed at the federal level will not be taxed within Maine.

The rates ranged from 0 to 795 for tax years beginning after December 31 2012 but before January 1 2016. So for example if you receive 12000 in Social Security benefits this year you cannot claim the deduction on your other forms of retirement income. Retirement distributions need to be reviewed to ensure a proper reconciliation with Maine law occurs.

Although the good news is that Maine does not tax Social Security Income. The tax treatment at the federal level of these retirement distributions is addressed in Pub 4491 Chapter 18 - Pension Income and on this site at Federal - Retirement Income. If you believe that your refund may be set-off to pay a debt other than an income tax debt you must contact the other tax department or agency directly to request injured spouse relief.

This is a SAMPLE onlyplease do.

Maine Retirement Tax Friendliness Smartasset

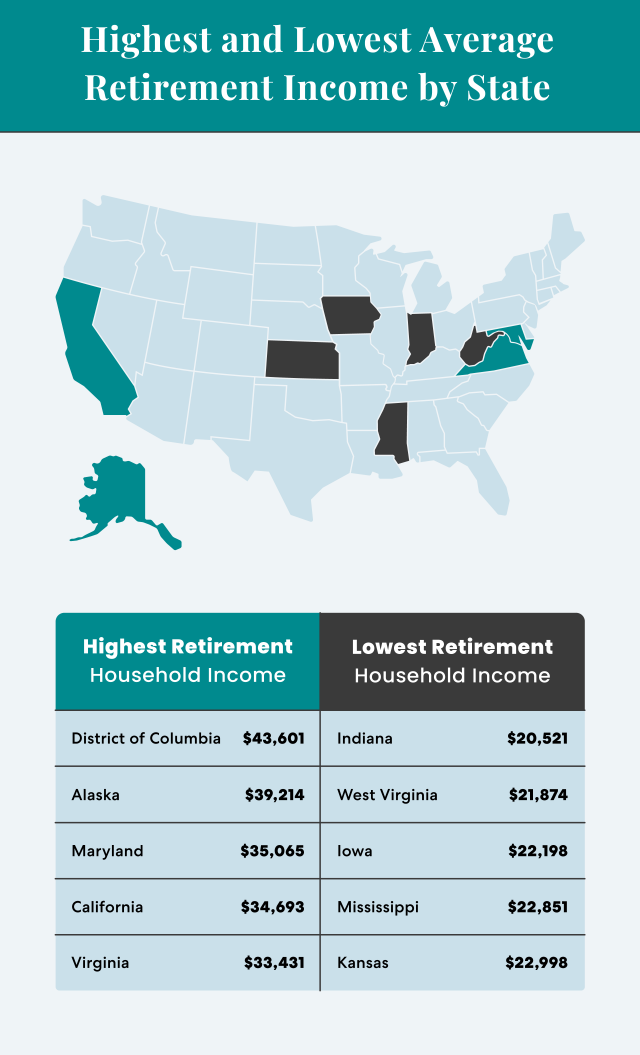

Average Retirement Income Where Do You Stand

11 Pros And Cons Of Retiring In Maine 2020 Aging Greatly

Maine Retirement Tax Friendliness Smartasset

Maine Income Tax Calculator Smartasset

Social Security Is A Critical Source Of Retirement Income Yet By 2030 The Trust That Helps Fund Benefits Diy Woodworking Woodworking Plans Retirement Income

Military Retirees Retirement Retired Military Military Retirement

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Maine Retirement Taxes And Economic Factors To Consider

Maine Retirement System Pension Info Taxes Financial Health

Benefit Payment And Tax Information Mainepers

The Harsh Reality For People With Disabilities Work And Struggle To Afford Medicine Or Stay Home And Struggle To Live Is Disability How To Apply Incentive

Maine Retirement Guide Maine Best Places To Retire Top Retirements

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

Retiring In Maine Vs New Hampshire Which Is Better 2021 Aging Greatly

12 Reasons To Retire In Maine Down East Magazine